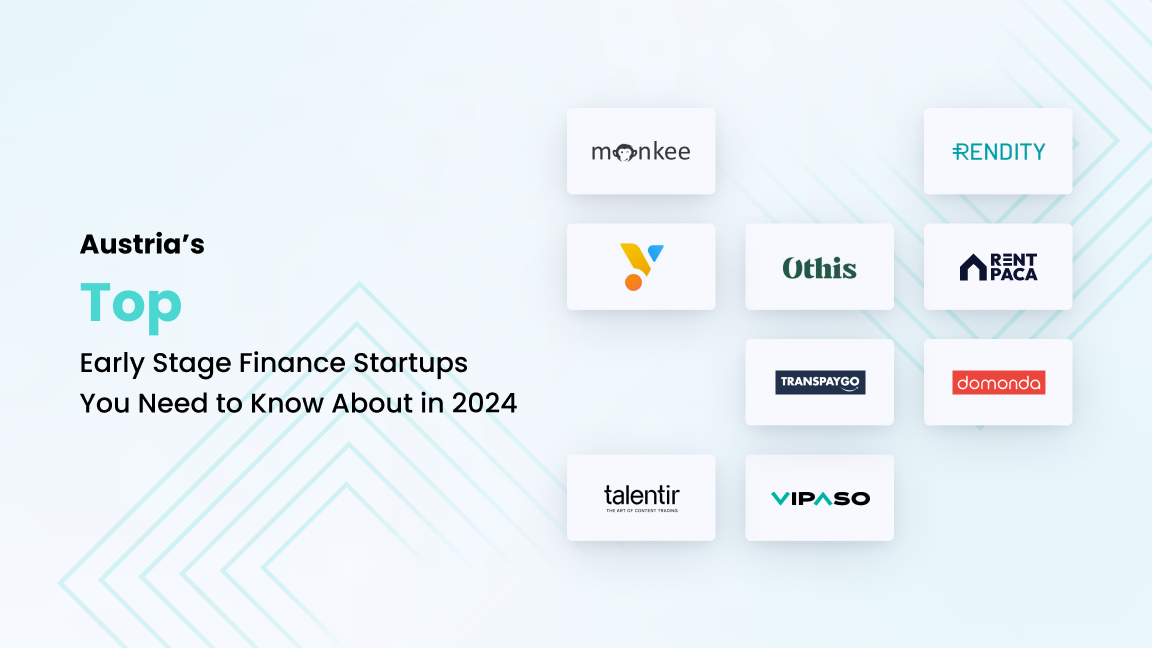

Austria's Top Early-Stage Finance Startups You Need to Know About in 2024

Austria's financial sector is undergoing a significant transformation, driven by the rise of fintech startups in Austria. This article explores some of the innovative companies reshaping Austria's finance landscape in 2024, focusing on key areas of growth—payments, investments, insurance, accounting, asset management, proptech, and real estate. We'll delve into how these startups leverage technology to disrupt traditional financial systems and empower consumers.

Top Early-Stage Finance Startups to Watch in Austria

-

-

• Monkee - Pioneering Financial Discipline with Innovative Savings Solutions

- Headquarters - Innsbruck, Tirol, Austria

- Founders - Christian Schneider, Martin Granig

- Establishment year - 2018

- Funding(in USD) - $3.2 Million

- Investor/s - Startup Wise Guys, austria Wirtschaftsservice (aws), The Austrian Research Promotion Agency (FFG), European Super Angels Club, Vereinigte Volksbank Raiffeisenbank

- Monkee empowers individuals to reach their financial goals by enhancing their savings. With each purchase made through Monkee partners, they offer a superior alternative to traditional interest with FutureBoost. Their "Save Now Buy Later" model promotes responsible saving, enabling users to earn up to 20% cashback on purchases. Collaborating with state-regulated banks, Monkee ensures unlimited insolvency protection and guarantees the confidentiality of your data. The Smart Money Card and electronic financial coach facilitate smart and secure saving, breaking down goals into manageable weekly targets while providing useful tips and reminders.

-

• Rendity - Democratizing Real Estate Investment for All

- Headquarters - Vienna, Wien, Austria

- Founders - Lukas Muller, Paul Brezina, Tobias Leodolter

- Establishment year - 2015

- Funding(in USD) - $2.1 Million

- Investor/s - aws Gründungsfonds

- Rendity allows users to invest in real estate starting from just €100. Offering a variety of urban investment opportunities from reputable developers, Rendity's platform makes investing in real estate transparent and accessible. Users can build a digital real estate portfolio in minutes, generating additional income through rental properties, development projects, or fixed-income bonds.

-

• Yolly - Simplifying Financial Management for SMEs

- Headquarters - Vienna, Wien, Austria

- Founders - John Shen, Navid Sianaki, Sebastian Schmid, Javier Durante

- Establishment year - 2019

- Funding(in USD) - $100,000

- Investor/s - EXPERT DOJO

- Yolly streamlines financial management for small and medium-sized businesses (SMEs) by automating repetitive tasks. Leveraging the EU's Open Banking directive, Yolly consolidates financial data into one place, providing a real-time overview of finances and reducing reliance on manual data handling and expensive tax advisors. Yolly aims to replace multiple financial tools with a single platform, simplifying the management of bank accounts, accounting software, and more.

-

• Othis - Comprehensive Wealth Management for Individuals and Families

- Headquarters - Vienna, Wien, Austria

- Founders - Evgeny Zasorin, Saang Lee, Stefan Haubner

- Establishment year - 2022

- Funding(in USD) - NA

- Investor/s - NA

- Othis offers a wealth management platform designed to simplify and centralize finances. Individuals and families can gain a consolidated view of their net worth, including assets held across various accounts and alternative investments. The platform aggregates data and keeps it up-to-date, empowering users to make informed financial decisions.

-

• Rentpaca - Revolutionizing Rental Deposits with a Cashless Alternative

- Headquarters - Vienna, Wien, Austria

- Founders - Daniel Wiederkehr-Prundianu

- Establishment year - 2023

- Funding(in USD) - NA

- Investor/s - Peter Steinberger

- Rentpaca is a PropTech startup in Austria that is revolutionizing the rental deposit process. They offer a cashless deposit alternative that benefits both landlords and tenants. Landlords can avoid the hassle of handling deposits and receive a guarantee from Rentpaca and their partners, while tenants can free up their cash for other uses. Rentpaca also offers several features that make the process easier for property managers, such as effortless tenant onboarding, secure storage of bank guarantees, and lightning-fast payouts for bail claims.

-

• Transpaygo - Streamlining International Money Transfers for Businesses

- Headquarters - Vienna, Wien, Austria

- Founders - Matthias Wurmboeck, Mirko Kinigadner

- Establishment year - 2012

- Funding(in USD) - NA

- Investor/s - FLOOR13

- Transpaygo specializes in international money transfers. They cater to businesses that deal with various international financial activities like paying salaries and contractors overseas, managing international licensing fees, and sending payments to international suppliers. They also facilitate international investments and receiving payments in foreign currencies. Whether you're a business distributing dividends to international shareholders or looking for competitive exchange rates and transparent transactions, Transpaygo claims to be the smart solution for your international money transfer needs.

-

• DOMONDA GmbH - Automating Accounting Processes for SMEs

- Headquarters - Vienna, Wien, Austria

- Founders - Erik Unger, Stefan Spiegel, Mathias Kimpl(CEO)

- Establishment year - 2017

- Funding(in USD) - NA

- Investor/s - Growth Ninjas GmbH

- Domonda offers financial automation software designed to streamline accounting processes for SMEs and optimized specially for German-speaking countries. With features like AI-powered document processing, digital invoice approval workflows, and automatic expense accounting, Domonda saves time and money while providing clear financial insights. Integrating with bank accounts, credit cards, and popular payment platforms, Domonda delivers a comprehensive financial management solution.

-

• Talentir - Empowering YouTube Creators with Co-Ownership Opportunities

- Headquarters - Vienna, Wien, Austria

- Founders - Johannes Kares, Lukas Steiner

- Establishment year - 2022

- Funding(in USD) - NA

- Investor/s - NA

- Talenter is transforming YouTube content creation by enabling co-ownership. Through blockchain technology, creators can share revenue, engage fans, and secure funding. Talenter's platform facilitates the launch and management of co-ownership campaigns, enhancing audience engagement and opening new revenue streams. Their secure technology streamlines rights management and ensures fast, transparent payouts.

-

• VIPASO – Vienna Payment Solutions - Promoting Financial Inclusion with Mobile Payments

- Headquarters - Vienna, Wien, Austria

- Founders - Wolfgang Platz, Matthias Horvath

- Establishment year - 2019

- Funding(in USD) - NA

- Investor/s - NA

- The Vipaso is a mobile payment app designed for accessibility and security. Using Bluetooth Low Energy, Vipaso enables contactless payments worldwide, even on basic phones. Their goal is to promote financial inclusion and growth in developing economies, offering a user-friendly, affordable, and secure payment solution.

-

- Top 10 Early Stage VCs in Austria

- Top 10 Early Stage Healthcare Startups in Austria

- Top 10 Early Stage AI Startups in Austria

The Benefits of Investing in Austrian Early Stage Fintech

Understanding the Investment Landscape

A trend in the investment landscape for early-stage finance startups in Austria from 2020 to 2024, based on data from the Zefyron startup database and publicly announced funding rounds, reveals initial stability and slight growth in early-stage funding (seed and pre-seed) from 2020 to 2021, followed by a downward trend from 2022 to 2024, ending at around $20 million for the first few months of 2024. In contrast, total funding peaked at over $1 billion in 2020 and 2021, sharply decreased in 2022 and 2023, and slightly recovered to over $300 million in 2024. This pattern suggests an initial growth phase in early-stage investments, which later waned, while overall funding experienced a substantial drop but showed signs of a potential rebound in the most recent year.

A Strong Foundation for Fintech Growth : A Stable Economy, A Hub of Talent and An Early Access to Promising Ventures

Austria's robust economy creates an attractive environment for fintech growth. The country boasts a skilled workforce, supported by excellent educational institutions and a strong focus on technology and entrepreneurship. Investors can join Austria's fintech revolution, gaining early access to startups with high growth potential. This early involvement can lead to significant returns as these ventures expand.

The Future of Finance is Bright: Why You Should Keep an Eye on Austria's Fintech Scene

The growth of digital banking indicates a shift towards more integrated and user-centric financial services. Open banking offers opportunities for personalized financial products, enhanced data security, and more competitive services. Austria can boost open banking adoption by increasing digital readiness and fostering collaboration between banks, fintechs, and regulators, making open banking more accessible and appealing. Keeping an eye on Austria's fintech scene could be a strategic move for forward-thinking investors.

Explore More About Austria's Thriving Startup Ecosystem

To explore further insights into such trends and emerging startups, visit Zefyron

◾About Zefyron - Zefyron offers a comprehensive database with 2M startups and 350K investors, facilitating easy connections and networking. Our platform streamlines fundraising and investor scouting with tools like pitch decks and valuations. Users can efficiently manage portfolios, gain insights, host events, and track industry trends for informed decisions and meaningful collaborations.