Seeding Innovation: Navigating Early-Stage Venture Capitals in Germany

Germany's startup scene is exploding with fresh ideas. VC firms are pouring fuel on this fire, backing groundbreaking ventures across exciting sectors. Imagine partnering with these VCs and gaining access to a treasure trove of potential industry disruptors! But for young startups, the initial hurdle is securing funding to launch their dreams. This is where Early Stage Venture Capital (VC) firms come in, acting as the secret weapon for these young companies. They provide the resources to transform promising ideas into industry-changing businesses. Buckle up, as we delve deeper into the world of Early Stage VC in Germany.

Understanding the Landscape of German Venture Capital for Startups

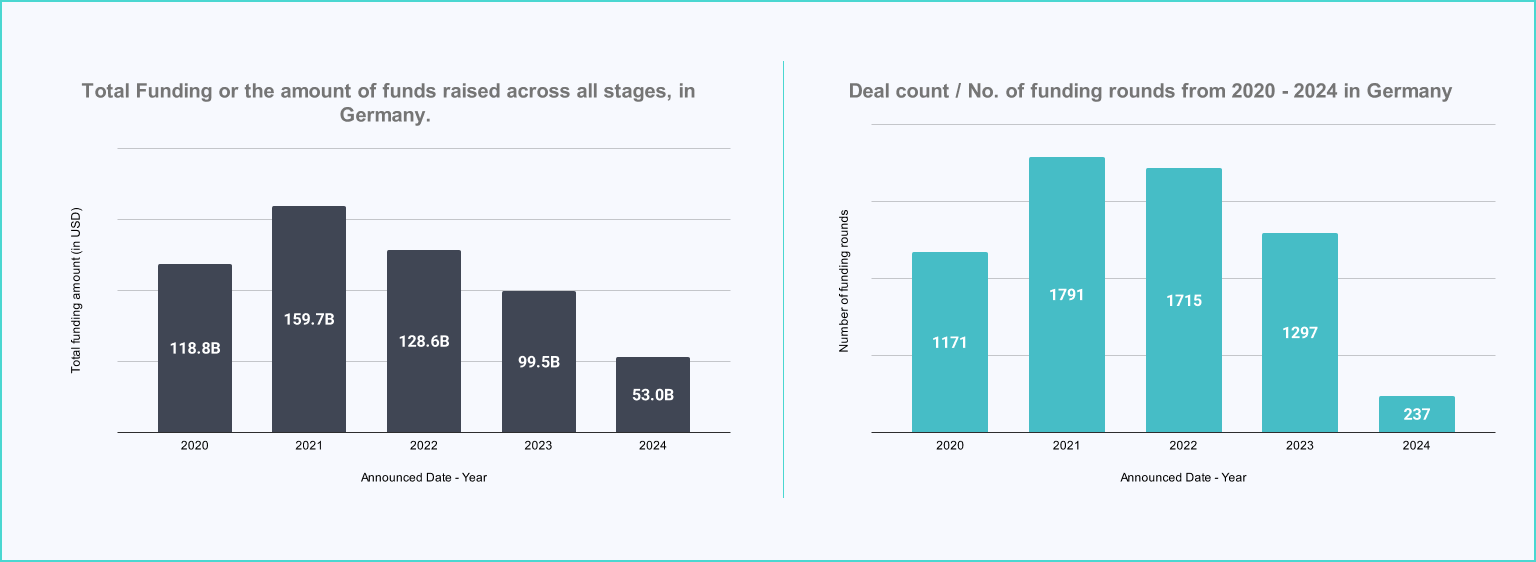

Germany's startup ecosystem has been a tale of two halves. Funding surged by a whopping 53% from 2020 to 2021, according to Zefyron Startup Database. This impressive growth solidified Germany's position as a leading European innovation hub. However, global economic headwinds brought a shift in fortunes. Funding dipped slightly by 4% in 2022, followed by a more significant 24% plunge in 2023. This resulted in total funding dropping from a peak of €159.7 billion in 2021 to €99.5 billion in 2023. The initial years (2020-2021) saw a clear upward trend, starting at €118.8 billion and reaching the aforementioned peak. While the first four months of 2024 show some promise with 237 funding rounds announced, it's still too early to determine the year's overall performance.

Key Players in Germany's Early-Stage Investment Scene:

-

-

1. SquareOne - Supporting founders who are obsessed with solving complex problems.

- Location - Berlin, Germany

- Establishment year - 2010

- Partners/Founders - Christian Buchenau, Federico Wengi, Georg Stockinger

- Investment stage - Pre-Seed to Series C.

- SquareOne, formerly Paua Ventures, is a VC firm with over 46 investments across Europe and the US, they focus on pre-seed and seed investments in B2B technology, including AI, Deep-tech, SaaS, and Enterprise Software. They offer an average investment size of $1m to $5m and provide a unique first-customers-guarantee to portfolio companies, supporting them as hands-on partners from day one. Their portfolio includes companies like Stripe, Pipedrive, Carbon One, and Wandelbots.

-

2. Join Capital - Helping Europe’s deep tech startups gain next-level traction.

- Location - Berlin, Germany

- Establishment year - 2015

- Partners/Founders - Jan Borgstädt,Sebastian v. Ribbentrop and Tobias P. Schirmer

- Investment stage - Pre-Seed to Series B

- Join Capital is a VC firm with a passion for groundbreaking tech. They've invested in 35+ startups across Europe, focusing on Germany and the UK. Their interest spans PropTech, Robotics, Enterprise Tech, Semiconductor development Supply Chain and many more. They invest from EUR 0.75 million to EUR 2 million at Seed to Series B stages.

-

3. First Momentum Ventures - Invest with a deeply entrepreneurial “From Founders to Founders” mindset.

- Location - Karlsruhe, Baden-Wurttemberg, Germany

- Establishment year - 2015

- Partners/Founders - Sebastian Boehmer,David Meiborg and Andreas Fischer

- Investment stage - Pre-Seed and Seed Round

- First Momentum Ventures is a specialized VC fund based in the DACH region, focusing on Pre-Seed to B2B, Tech, and Deep Tech startups. With over 32 investments, they typically invest between €250k and €1m as the "First Check" investor, collaborating with Angels and other VCs for Co- & Follow-On Investments. Their interest sectors include Climate & Energy, Deeptech, Machine Learning, and Enterprise Software.

-

4. LEA Partners - Supports ambitious B2B Tech founders.

- Location - Karlsruhe, Baden-Wurttemberg, Germany

- Establishment year - 2002

- Partners/Founders - Sebastian Müller, Christian Roth

- Investment stage - Pre-Seed to Series B

- LEA Partners is a multi-stage private equity and venture capital firm focused on ambitious B2B Tech founders in Germany. With over 32 investments, they focus in sectors like Artificial Intelligence, Machine Learning,Deeptech and many more. They offer hands-on growth expertise and typically invest between $1M to $5M.

-

5. Lunar Ventures - Backing European Deeptech founders.

- Location - Berlin, Germany

- Establishment year - 2017

- Partners/Founders - Mick Halsband, Elad Verbin, ,Alberto Cresto

- Investment stage - Pre Seed and Seed Round

- Lunar Ventures is a Berlin-based seed-stage venture fund specializing in deep tech, with over 21 investments typically ranging from €300K to €1M. Their team of three deep-tech experts brings a unique blend of software architecture, computer science, and business strategy expertise. They focus on early-stage startups in ML, blockchain, cryptography, and databases across Europe.

-

6. Revent - fuels European startups driving impactful change in Health, Economics, Sustainability, and Food.

- Location - Berlin, Germany

- Establishment year - 2020

- Partners/Founders - Dr. Lauren Lentz, Otto Birnbaum

- Investment stage - Pre Seed and Seed

- Revent is an Early stage venture fund, investing throughout Europe, with investment sizes ranging from 200,000 to 2 million euros. We seek out companies utilizing robust, highly scalable technology to catalyze significant advancements in the realms of Health and Wellbeing, Economic Empowerment, Sustainable Planet, and The Future of Food. With a portfolio of over 20 companies, we prioritize identifying ventures with the potential to achieve $100 million in Annual Recurring Revenue (ARR) and deliver impactful returns within the next decade, aligning with our commitment to fostering positive societal change.

-

7. YZR Capital - Empowering healthcare sector founders to drive impactful change.

- Location - Munich, Bayern, Germany

- Establishment year - 2021

- Partners/Founders - Prof. Dr. Reinhard Meier, Markus Feuerecker

- Investment stage - Pre-seed, Seed and Series A

- YZR, a venture capital firm, merges seasoned Serial Entrepreneurs, Venture Capital Investors, and Private Equity Professionals to empower outstanding entrepreneurs in Europe's health tech sector. They support companies enhancing healthcare efficiency, transparency, and wellness accessibility. Their collaborative approach fosters personal connections, accelerating growth while respecting founder autonomy. With investments in over 13 companies, they drive transformative innovation in European healthcare.

-

8. Soleria Capital - Backing unique global tech companies.

- Location - Munich, Bayern, Germany

- Establishment year - 2015

- Partners/Founders- Christian Siemoneit

- Investment stage - Seed to Series A

- Soleria is a crossover investment boutique specializing in early-stage technology investments on a global scale. Primarily concentrating on B2B SaaS ventures, they've supported over nine distinct companies spanning Germany and the US. Additionally, they oversee a compact public markets selection, aiming at worldwide growth-oriented tech stocks. Their investment scope typically falls between $400k and $2M.

-

9. Climate Insiders - Helping founders who accelerate the climate fight

- Location - Berlin, Germany

- Establishment year - 2022

- Partners/Founders - Yoann Berno

- Investment stage - Pre-seed and Seed Round

- Climate Insiders is a company focused on investing in startups led by exceptional founders to accelerate the climate fight and transform society positively. They aim to align personal values with investment strategies, enabling professional angel investors to contribute to climate solutions. With over 8 investments made ,Climate Insiders is actively engaged in the climate tech sector, particularly in Europe, supporting innovative ventures that drive environmental impact. Their investments are geared towards fostering sustainability, cleantech, and climate-positive initiatives, reflecting a commitment to advancing solutions for a greener planet.

-

10. Identity Ventures - Supporting LGBTQ+ Founders through investing.

- Location - Berlin, Germany

- Establishment year - 2023

- Partners/Founders - Til Klein and Jochen Beutgen

- Investment stage - Early Stages

- Identity Ventures focuses on investments in LGBTQ+ led startups, with a primary focus on Europe and the U.S. They champion diverse leadership and typically engage in co-investing or co-leading, while generally refraining from occupying board seats. With a portfolio comprising around 4 companies, they empower LGBTQ+ entrepreneurs across various sectors, with a particular emphasis on the digital identity and data ecosystem.

-

The Early Bird Gets the Worm: Advantages of Partnering with German Early Stage VCs

In Germany, while later-stage VC activity intensifies, early-stage investors focus on lightning-fast startups with huge potential. These VCs specialize in specific sectors like fintech or healthtech, offering deep industry knowledge and connections. Investing early is risky but can yield huge rewards, especially with a VC who understands the landscape and is deeply rooted in the German startup community, helping navigate challenges for a smoother path to success.

Seize the Opportunity: Partner with German Early Stage VCs

If you have a groundbreaking idea with the potential to disrupt an industry, consider partnering with a German early-stage VC firm. They might just be the secret weapon that propels you towards becoming the next big thing.

Do your research, identify VCs aligned with your vision, and get ready to take the German startup ecosystem by storm!

To explore further insights into such trends and emerging startups, visit Zefyron