Funding Innovation : Early-Stage Venture Capital in Switzerland

Switzerland's reputation for excellence precedes it. For an impressive thirteen years in a row, the nation has secured the top spot on the Global Innovation Index, solidifying its position as a global leader. This innovative spirit fuels robust growth in sectors like ICT, Fintech, and Biotech making Switzerland a magnet for investors worldwide. Favorable valuations, a predictable financial market, and a business-friendly environment further sweeten the deal for those seeking a launchpad for groundbreaking ideas.

Understanding the Landscape of Swiss Venture Capital for Startups

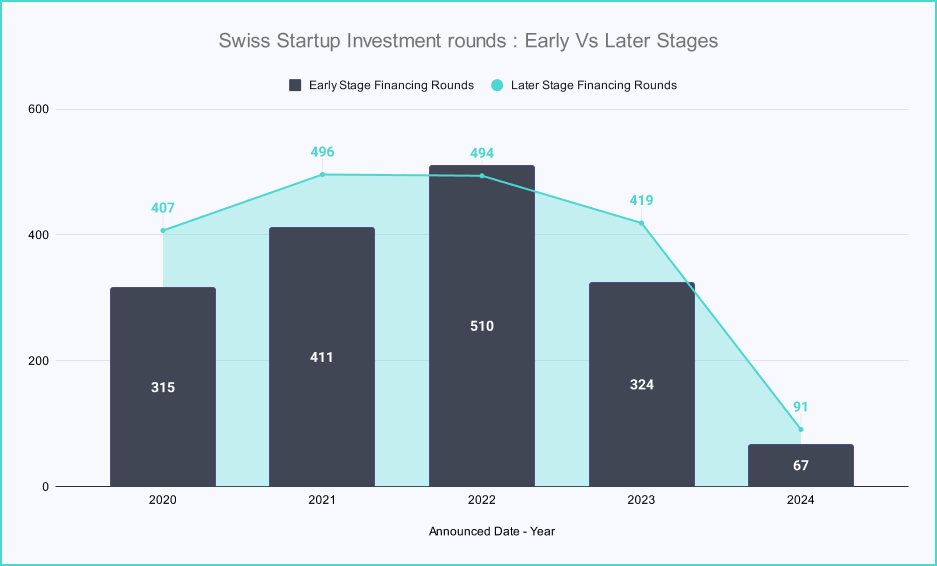

Early-stage investors were particularly enthusiastic in 2021 as well as 2022, pouring money into promising Swiss startups as per data from Zefyron startup database This surge led to a peak in early stage investment rounds, fostering the expansion of fledgling companies across diverse sectors. However, 2023 witnessed a downturn, with investment rounds declining by 25% across all stages and Swiss startup investments dropping by 34.8% compared to the previous year. Despite this, there are signs of improvement in 2024, with 128 financing rounds announced in the first quarter, hinting at a potential turnaround.

As the year progresses, it will be interesting to see if the positive momentum observed in Q1 2024 continues. According to startup.ch, The healthcare sector is currently at the forefront of Swiss startup investment, with Medtech emerging as the hottest industry for investors. Interestingly, early-stage funding continues to be the dominant force, accounting for a whopping 86% of all financing activities. The Swiss startup scene remains a dynamic and exciting space to watch.

Key Players in Switzerland's Early-Stage Investment Scene :

Swiss startups looking for early funding can find support from a vibrant domestic investment scene. Key players include venture capital firms focused on pre-seed, seed, and Series A rounds.

-

-

1. Tomahawk.VC - Focuses on innovative FinTech and DeFi companies.

- Location - Pfäffikon, Schwyz, Switzerland

- Establishment year - 2019

- Partners/Founders - Cédric Waldburger

- Investment stage - Pre-Seed, Seed and Series A rounds

- Tomahawk.VC is a venture capital firm investing in innovative FinTech and DeFi companies around the world. They've actively supported over 33 startups with investments ranging from $250k to $1.5M per deal, and up to $2M per company. Their commitment goes beyond funding, as they value transparency and prioritize clear communication to empower founders globally.

-

2. Sangha Capital - Investment focus on Climate Tech, Technology, and Artificial Intelligence sectors.

- Location - Geneva, Switzerland

- Establishment year - 2020

- Partners/Founders - Carolina Casas Forga, Bill Tai, Berta Casas Forga, Damià Tormo Carulla

- Investment stage - Early Stage

- SANGHA Capital, a tech investment fund driven by purpose, has invested in over 27 projects spanning various sectors such as Climate Tech, Technology, and Artificial Intelligence with a global focus. Dedicated to addressing global issues in line with the UN Sustainable Development Goals, they cultivate a network of entrepreneurs, investors, and activists. SANGHA places equal emphasis on financial returns and social impact, recognizing the transformative potential of technology in shaping a better future.

-

3. LongeVC - Empowers early-stage biotech champions.

- Location - Paradiso, Lugano, Switzerland

- Establishment year - 2016

- Partners/Founders - Garri Zmudze, Ilya Suharenko, Sergey Jakimov

- Investment stage - Seed to Series A

- LongeVC focuses on empowering early-stage biotech founders, having made 19+ investments. Their mission involves aiding companies in achieving industrial traction, securing funding, and shaping the future of biotech, spanning Therapeutics, Diagnostics & Prevention, and Longevity Infrastructure. Employing a comprehensive strategy, they support complementary industrial sectors, nurturing a diverse community of biotech innovators to facilitate the exchange of expertise and mutual growth.

-

4. Carbon Removal Partners - Supports ventures developing carbon removal technologies

- Location - Zurich, Switzerland

- Establishment year - 2022

- Partners/Founders - Max Zeller, Benjamin Schulz

- Investment stage - Pre-Seed to Series A

- Carbon Removal Partners is a venture capital firm with a specialized focus on the carbon removal sector, having made over 15 investments. Their investment strategy revolves around supporting technologies designed to permanently remove carbon from the atmosphere, as well as backing companies involved in various aspects of the Carbon Removal value chain. Their mission is to partner with the most ambitious entrepreneurs in this field, working towards the tangible realization of reversing humanity's carbon emissions.

-

5. 14Peaks Capital - Fuels B2B SaaS innovation in Fintech and Future of Work sectors.

- Location - Zug, Switzerland

- Establishment year - 2022

- Partners/Founders - Edoardo E. Ermotti

- Investment stage - Pre-Seed to Series A

- 14Peaks Capital specializes in early-stage investments within B2B SaaS companies across Europe and the US, particularly focusing on Fintech and the Future of Work sectors. They collaborate closely with founders, providing not only capital but also operational guidance, access to a vast network, and strategic counsel throughout the growth trajectory. With a portfolio comprising over 11 investments, they actively foster SaaS innovation.

-

6. Lightbird - Invests in Climate-Tech, Cyber Defense, and SaaS companies.

- Location - Bern, Switzerland

- Establishment year - 2021

- Partners/Founders - Thomas Meier, Benjamin Solenthaler

- Investment stage - Seed to Series A

- Lightbird specializes in forging early-stage partnerships with companies that prioritize distribution, underscoring its significance in the current market landscape. With over 8 investments spanning across Europe, the company specializes in Climate-Tech, Cyber Defense, and SaaS sectors, aiding ventures in building robust market presence right from the start.

-

7. Emma Ventures - Backs diverse founders building impactful tech in Healthcare, Fintech, EdTech, and more.

- Location - Zurich, Switzerland

- Establishment year - 2023

- Partners/Founders - Katja Baur, Christian Diller

- Investment stage - Early Stage

- Emma Ventures is a venture capital firm specializing in Digital Healthcare, Software/SAAS, Fintech, Insurtech, Edtech, Foodtech, and Consumer sectors within the DACH region. With a portfolio spanning over 5 investments, they back mission-driven founders from diverse backgrounds, endeavoring to cultivate sustainable businesses for a brighter tomorrow. Additionally, they allocate investments to handpicked VC funds across Europe and the US.

-

8. QAI Ventures - Accelerates Quantum and Advanced AI startups.

- Location - Arlesheim, Basel, Switzerland

- Establishment year - 2023

- Partners/Founders- Alexandra Beckstein

- Investment stage - Pre-seed to Series-A

- QAI Ventures spearheads the global transformation of Quantum Technologies by strategically investing in startups and fostering ecosystem collaboration. They expedite and support Quantum and Advanced AI startups at various stages, from Lab to Early-Stage and Seed, with the goal of fostering global unity amid the Quantum revolution. With a portfolio of over 5 investments, they drive progress that reshapes economies and societies, supporting ventures from pre-seed to Series-A with investment amounts ranging between CHF 500k and 2M.

-

9. Forty51 Ventures - Boosts European early-stage biotech investments

- Location - Basel, Switzerland

- Establishment year - 2022

- Partners/Founders - Sara Núñez-Garcia, Sascha-Oliver Bucher

- Investment stage - Early Stages

- FORTY51 Ventures specializes in European early-stage biotech investments, prioritizing those with a clear path to the clinic, be it single-asset or platform-based. As the first institutional investor, they focus on CNS, oncology, immunology, inflammation, fibrotic disorders, and ophthalmology, aiming to advance therapeutic breakthroughs. With over 3 investments, they drive innovation in biotech.

-

10. Apprecia Capital - Supports startups tackling climate change, Advanced Materials, and Generative AI.

- Location - Zurich, Switzerland

- Establishment year - 2022

- Partners/Founders - Emi (Hidemi) Naganuma

- Investment stage - Early stage

- Apprecia Capital invests in early-stage European startups with bold innovations in Net Zero Technologies, Advanced Materials, and Generative AI. With over 3 investments, they support purpose-driven founders in creating a virtuous cycle for the planet and human health through their expertise and network.

-

Investor Sentiment: Cautious Optimism

Investors appear cautiously optimistic compared to the previous year. The current economic climate, characterized by high inflation, rising interest rates, and geopolitical tensions, has spurred a shift towards more conservative financing approaches. This has led to a decrease in funding from specialist venture capitalists traditionally focused on early-stage startups. However, as Alexander Schatt, Head Startups & Scale-ups at EY in Switzerland, suggests, companies in AI (Artificial Intelligence), climate technology, sustainability or those offering cost-saving solutions might find a more receptive environment for fundraising.

For insights into similar trends, emerging startups, and venture capitalists, visit Zefyron