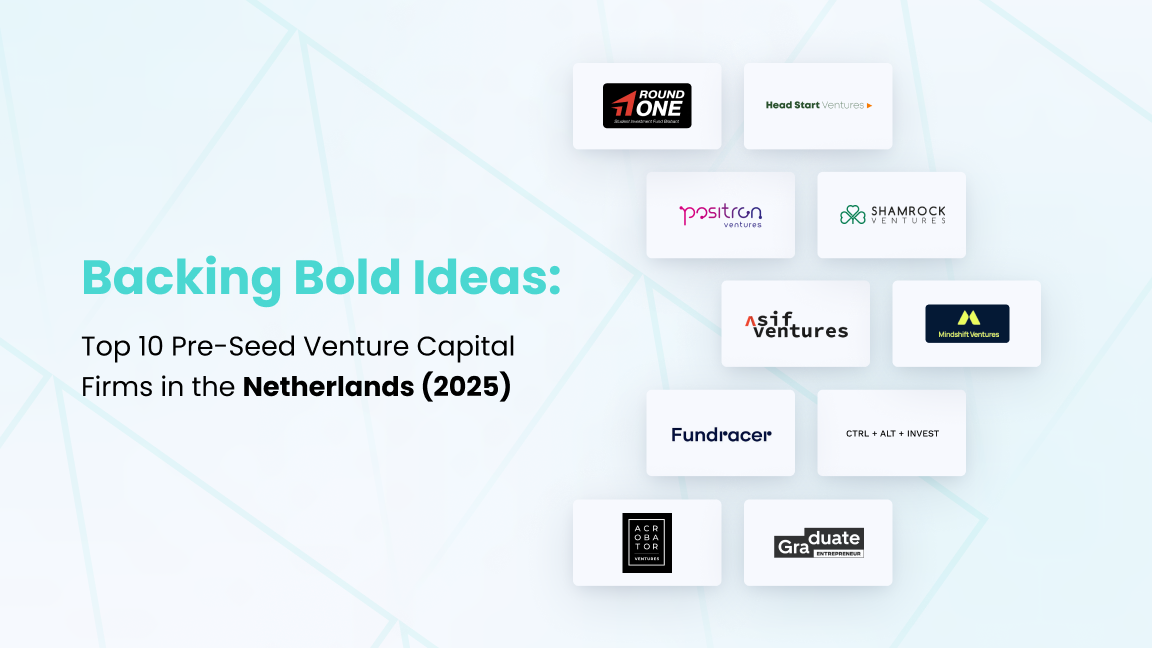

Backing Bold Ideas: Top 10 Pre-Seed Venture Capital Firms in the Netherlands (2025)

The Netherlands consistently ranks among the top European countries for venture capital funding, attracting both local and international venture capital (VC) investors. In 2024, Dutch startups secured $3.5 billion in VC investments, marking the country’s second-best funding year on record. With a strong focus on technology and sustainability, the Dutch startup ecosystem continues to thrive.

The Role of Pre-Seed Funding

Pre-seed funding helps startups refine their ideas, build teams, and develop minimum viable products (MVPs). Beyond capital, VC firms offer mentorship, industry expertise, and networking to accelerate growth.

While pre-seed VC deals continue to be essential for early-stage startups, the Dutch pre-seed VC market has seen a decline as investors increasingly prioritize later-stage funding. Foreign venture capital firms play a significant role in the Netherlands, with investment amounts on par with domestic funds. However, the limited participation of Dutch institutional investors remains a challenge. Bridging these gaps could unlock substantial capital for startups and further enhance the country’s innovation ecosystem.

-

-

1. Round One Ventures - Funds and mentors student entrepreneurs

- Headquarters - Eindhoven, Noord-Brabant, The Netherlands

- Founding Year - 2021

- Founders / Partners - Bob van der Meulen, Jasper Wennink, Jur van Bergen, Rikke Schrauwen

- Investment Focus - Technology-driven, scalable startups

- Investment Size - €25,000 - €75,000 (Convertible Note) (Pre-seed)

- Round One Ventures supports young entrepreneurs with convertible notes and expert guidance. The firm primarily invests in students or recent graduates with high-growth business ideas. Startups also benefit from mentoring, international expansion pathways, and access to student employees.

-

2. Head Start Ventures - Coaching and funding high-potential startups

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2020

- Founders / Partners - Floris van den Dries, Folef Hooft Graafland, Reinier Snethlage

- Investment Focus - Scalable businesses across industries

- Investment Size/Stage - Pre-Seed

- Head Start Ventures invests in promising startups and actively coaches entrepreneurs. The firm leverages its experience and network to help founders secure follow-on funding and accelerate growth. The firm has backed three startups so far.

-

3. Positron Ventures - Turning science into scalable businesses

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2022

- Founders / Partners - Joseph Peeraer, Gijs van der Hulst

- Investment Focus - Science-driven startups solving major global challenges

- Investment Size/Stage - Pre-seed

- Positron Ventures supports scientist-entrepreneurs working on breakthrough innovations. The firm provides funding and guidance to help transform scientific discoveries into scalable businesses with global impact. It has invested in eight startups to date.

-

4. Shamrock Ventures - Backing bold ideas in sustainability

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2021

- Founders / Partners - Tommy Hurley, Alef Arendsen, Joost van de Wijgerd, David Markowski, Roland Sars and more.

- Investment Focus - Circular economy, sustainable mobility, cleantech, food & agritech

- Investment Size - €100,000 - €250,000 (Pre-Seed)

- Shamrock Ventures invests solely in companies based in the Netherlands, with a strong focus on pre-seed funding. The firm backs mission-driven founders and can take on the role of lead investor or co-investor, with the possibility of follow-on investments in later rounds. Startups do not need to have revenue or a minimum viable product (MVP) to secure funding—Shamrock Ventures invests in the vision and the founding team.

-

5. Asif Ventures - Supporting student-led startups

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2017

- Founders / Partners - Julian Felipe Sandoval Ospino

- Investment Focus - Student-led startups

- Investment Size - €40,000 (Convertible Loan) (Pre-seed)

- ASIF Ventures bridges the gap between student entrepreneurs and VC funding in Amsterdam. The firm primarily supports startups founded by students or recent graduates from the University of Amsterdam or Vrije Universiteit, focusing on early-stage investments. Its portfolio includes 20 startups, with 3 successful exits.

-

6. Mindshift Ventures - Fast-track funding for globally scalable startups

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2023

- Founders / Partners - Victor van Bommel, Ahmed Mounir

- Investment Focus - Sectors Agnostic

- Investment Size - Up to €2.0M (Pre-seed to Pre-Series A)

- Mindshift Ventures looks for startups with a strong founding team, a clear vision, and a scalable business model. They prioritize companies operating in large global markets and offer fast investment decisions to help founders move quickly.

-

7. Fundracer Capital - Investing in disruptive micro-mobility solutions

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2024

- Founders / Partners - René Wiertz, Gerard Vroomen, Andy Ording

- Investment Focus - Micro-mobility startups

- Investment Size/Stage - Pre-seed to Series A

- Fundracer Capital invests in cycling technology and micro-mobility solutions aimed at easing urban congestion. Led by seasoned industry entrepreneurs, it provides funding and strategic support, having already backed three startups. The fund focuses on startups across Europe and North America.

-

8. CTRL+ALT+INVEST - Scaling early-stage tech startups

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2024

- Founders / Partners - Lennard Zwart, Jalal Bouhdada

- Investment Focus - Technology, finance, cybersecurity, SaaS, and cloud computing

- Investment Size - €500K - €2.5M

- CTRL+ALT+INVEST funds early-stage tech ventures, offering capital, mentorship, and strategic networking. With industry expertise, they provide hands-on support to help startups scale efficiently. The firm has already invested in two startups.

-

9. Acrobator VC - Backing High-Growth AI & SaaS Startups in Emerging Markets

- Headquarters - Amsterdam, Noord-Holland, The Netherlands

- Founding Year - 2019

- Founders / Partners - Bas Godska, Joachim Laqueur & more

- Investment Focus - B2B(2C) AI/ML software

- Investment Size - $200K - $1.25M (Pre-seed and Seed)

- Acrobator VC strategically supports founders from CIS, the Baltics, and CEE in building global software platforms. With a portfolio of 100+ startups, the firm leverages deep expertise in scaling SaaS and AI/ML companies, actively guiding founders in growth and business development.

-

10. Graduate Entrepreneur Fund - Boosting Delft & Rotterdam alumni startups

- Headquarters - Rotterdam, Zuid-Holland, The Netherlands

- Founding Year - 2021

- Founders / Partners - Menno Antal, Auke van den Hout & more

- Investment Focus - Startups led by Delft & Rotterdam university alumni

- Investment Size - €75K - €2M

- The Graduate Entrepreneur Fund supports founders from Delft and Rotterdam universities through funding, mentorship, and access to an expansive network. They invest across pre-seed, seed, and Series A stages and offer both equity and convertible loan agreements. Their portfolio includes 40+ pre-seed startups.

-

Top 10 Pre-Seed Venture Capital Firms in the Netherlands

In this article, we highlight the top 10 pre-seed venture capital firms in the Netherlands that are actively backing high-potential startups. Whether you’re an entrepreneur seeking funding or an investor exploring the Dutch startup ecosystem, these firms are playing a key role in shaping the future of innovation.

Find More Pre-Seed Investors in the Netherlands/h3>

Discover over 100 pre-seed investors in the Netherlands on the Zefyron Startup Database and explore the right funding opportunities for your startup.

◾About Zefyron - Zefyron offers a comprehensive database with 2M startups and 350K investors, facilitating easy connections and networking. Our platform streamlines fundraising and investor scouting with tools like pitch decks and valuations. Users can efficiently manage portfolios, gain insights, host events, and track industry trends for informed decisions and meaningful collaborations.